UK house prices in key UK cities rose by 5.1% in the first half of 2017, the latest figures show.

Birmingham has seen the highest level of home price growth over the past year, as large regional cities outside the south of England continue to defy the general slowdown in the UK housing market, new figures reveal.

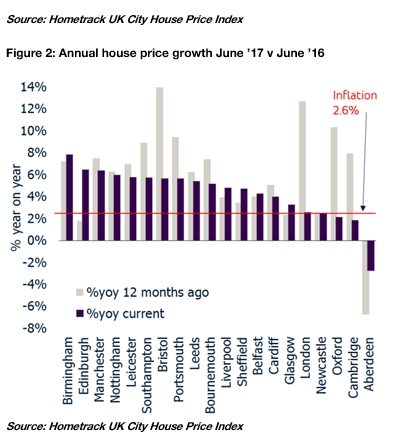

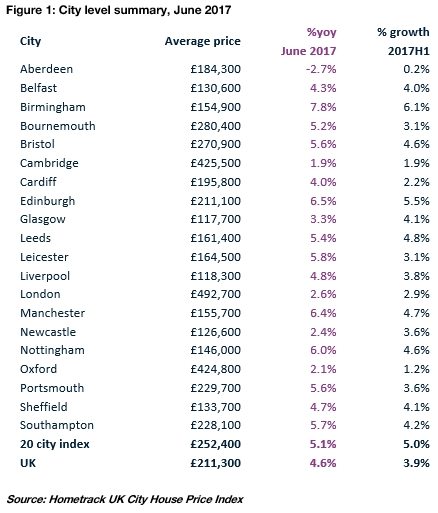

Growth in UK property prices slowed to 5.1% in June, down from down from 8.8% a year earlier, and yet the latest Hometrack index figures reveal that the average price of a home in Birmingham rose by 7.8% year-on-year, more than any other city in the UK, to reach an average of £164,900.

Birmingham was not the only northern city to see property prices outstrip the national average, with Manchester showing the second-highest increase over a 12 month period with a 6.4% rise to £155,700.

Overall, home prices in key UK cities during the first half of the year rose by an average of 5.1%, Hometrack said.

The hike in values takes the average price in the 20 cities covered by the index to £252,400 but there is some regional variation and some locations have seen a sharp slowdown, such as London where growth has fallen from 10.1% to 2.6% in the past 12 months.

Some 13 of the 20 cities which make up the index have a lower annual growth rate than a year ago, but it is London which has registered the most significant decline over the past 12 months. Despite this, Hometrack says that the rate of slowdown in the capital is starting to flatten out and average prices in the city rose 1.7% in the second quarter of the year.

Bristol, Oxford and Cambridge were also among the main cities to see a marked slowdown in the rate of house price growth.

“Despite a material slowdown in the rate of house price growth in south eastern England, the headline rate of city house price inflation is holding up, despite the squeeze on real incomes and uncertainty around Brexit,” said Richard Donnell, research and insight director at Hometrack.

He continued: “The Brexit impact was greatest over the second half of 2016 but house price growth has picked up over the last six months. This is consistent with an 11% increase in the number of home purchase mortgages, which is also 5% higher than the five year average.

“In London, the Brexit vote has had a greater impact on buyer sentiment and combined with affordability issues has led to a 10% reduction in the annual growth rate over the last 12 months. However, although house price inflation has fallen sharply in the capital it is starting to flatten out and the rate of growth is likely to avoid year on year price falls in the coming months.”