It’s becoming more difficult than ever to get onto the housing ladder thanks to soaring house prices and incomes remaining static. However, it is possible for many, and first-time buyers are still coming onto the market. It requires some planning to buy your first home, so here’s how to get started.

Budgeting for your deposit

The first thing you must do is build up a deposit. Banks typically require a down payment of between 10% and 25% so that they’re not taking all the risk. The larger the deposit, the lower your interest rate is likely to be, making it cheaper to borrow money.

To save up for a deposit, you need to budget your finances so that you regularly save hundreds of pounds a month. If you’re in London, you’ll need an average of £40,000, which means saving £8,000 each year over five years, but even that will only give you 10 percent deposit. If you’re in a less expensive area of the country, you’ll need an average of £20,000 for a 10 percent deposit.

This might mean cutting down on luxuries, especially overseas holidays, or it could mean making lots of small alterations that nonetheless save money, such as changing brands or going to different supermarkets so that your weekly shop is cheaper. It may even be worth cancelling various subscriptions, especially if you have multiple streaming services or gaming services.

Check your credit rating

Your credit rating also helps determine whether you get a mortgage. Paying off lines of credit helps to reduce expenses, and reducing your debt – such as car loans and so on – can help to improve your credit rating. If you are struggling, you may wish to talk to an independent financial advisor regarding what you can do and how you can mitigate your expenses. Your financial advisor may also suggest ways that you can improve your credit.

Because many lenders use typical APRs, they can quote higher rates than advertised for up to 49% of applicants. Consequently, the rate that you see may not be the rate that you get, and credit scores can help determine the level of risk that you presented the bank. Lowering your credit rating improves your chance of getting a lower interest rate or a larger mortgage.

Talk about mortgages

You can talk to an independent financial advisor about mortgages, or you can talk to a mortgage broker, who can look at what mortgages you can afford and how much you’re likely to get. You will, of course, need to know how big a deposit you can afford and look at what mortgages you can get as result. You’ll also need verifiable evidence of your income, such as payslips or tax returns, and you’ll likely be limited to somewhere between 2.5 times your earnings and 4.5 times your earnings.

Mortgages based on 4.5 times your earnings are likely to be significantly more expensive than mortgages based on 2.5 times your earnings. In addition, mortgages based on a 10% deposit are likely to be more expensive than those based on a 25% deposit.

In addition, because couples have more expenses than a single person, a combined income is likely to net you a much lower mortgage:

- Combined income of £40,000 per year: £100,000 to £140,000 mortgage

- Single income of £40,000 per year: £130,000 to £180,000 mortgage

You’ll also have to consider how much interest you’ll be paying, particularly after the fixed rate has expired. A £140,000 loan that has a 4% interest rate after the fixed rate has expired will cost you around £5,000 in interest after the second year, which is around £400 per month. You’ll need to pay some of the principal off, which would be around £250 to £300 per month for our hypothetical mortgage.

You’ll also need to consider what happens if interest rates rise and make allowances for that. Mortgage providers calculate their interest rates by applying a set percentage on top of the Bank of England base rate. Therefore, a 4% mortgage consists of:

- Bank of England base rate at 0.25%

- Mortgage provider’s markup at 3.75%

A rise in the Bank of England base rate from 0.25% to 1.25% would cost you up to £1,250 a year on that £140,000 mortgage, which could put extra strain on your finances. A rise from 0.25% to 2.25% would cost you an extra £3,000 or so, or an extra £250 per month. During 2007, the base rate was regularly above 5%.

That’s why it pays to discuss your particular financial situation, especially if you plan to have children or undertake anything that would put extra strain on your finances, with an independent financial advisor. Read more on mortgages and how to get one here.

Government help

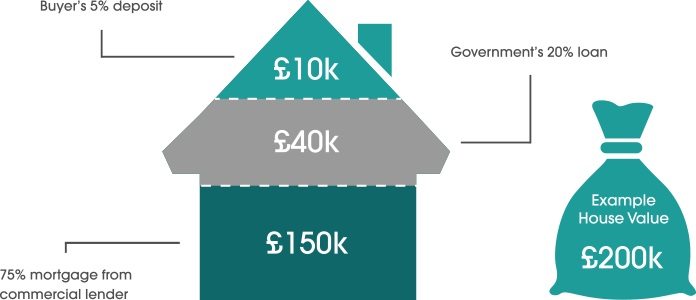

There are a number of government schemes available, including the Help to Buy ISA and the Help to Buy scheme, which is for new builds only. The latter consists of an equity loan (up to 20% of the value of the property) and a mortgage guarantee. However, carefully look at the fees and the requirements. These instruments can be somewhat more expensive in the long run than a standard mortgage.

In addition, a number of companies offer shared ownership, but these can be complex to sell and put off buyers when you want to move on. It pays to carefully look at your options to see exactly how the market reacts to these properties and whether your financial situation is appropriate for these products. Always remember to ask what happens if you want to sell the property and how easy is it to do so.

View prospective properties

Once you’ve decided how much you can afford and what options you’re willing to take, it’s time to view properties. Although you can make significant changes to properties as needed, particularly with respect to paint and carpets, you also need to make sure that the house is sound.

Look for areas of damp or poorly maintained exteriors. You also want to take a quick look in the electricity box to make sure that the electrics are up to date (the fuse box should look modern) and that the kitchen is of reasonable quality. It sometimes pays to take a friend who is knowledgeable about such matters if you’re not sure. If in doubt, read up on What to look for and the questions to ask when buying a property.

Once you’ve selected a potential property you will need to get a surveyor in and possibly get quotes from builders or other tradespeople if you plan on doing work to it. This will give you an idea about the total cost of buying the property and if there are any significant issues with it. You’ll also want to check the land registry documents and go over them with your solicitor. The land registry documents are usually available for around £9, but your solicitor will charge a fee. This can highlight any issues with shared ownership, flying freeholds and so on that could bring down the price of the property.

Getting your solicitor involved early also makes it easy to deal with potential issues as they arise.

Make an offer

Your offer should generally be lower than the asking price, and it should be made in line with the condition of the property and how much it would cost to set right, if relevant. If you are a cash buyer, you have a lot more flexibility, as you can move quicker and you can accept properties that mortgage providers wouldn’t touch, notably properties that require a lot of development.

Buying costs

Although your finance may already be arranged through a mortgage company, you’ll still need to pay costs such as stamp duty, legal fees and the cost of the survey. You’ll also want to get insurance as quickly as possible – make sure you check whether the area has recently been flooded, as this can make it difficult to get insurance. Even if your property is on top of a hill, if the planning maps show that it’s in a vulnerable zone, it can raise the price of insurance significantly if you don’t negotiate.

Moving time

Assuming that your offer is accepted and you successfully exchange contracts, it’s time to pick up the keys and move in. Congratulations!