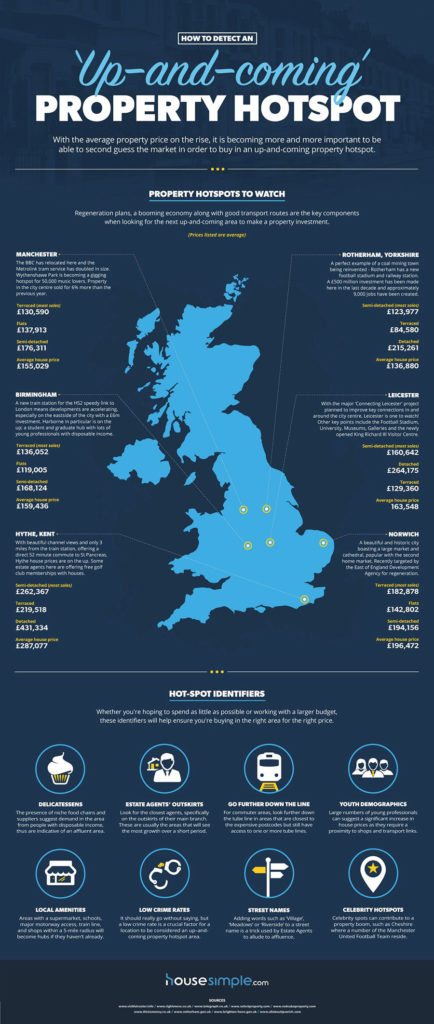

Housing experts have revealed ten locations in the UK where residential property prices are likely to soar in the next decade, with a mixture of cities and commuter towns featured in the list.

Interestingly, all ten locations are in England, and have a wide variation in property prices – from terraced homes averaging under £85,000 to detached houses close to £600,000.

But after analysing key indicators, such as up market places to eat, good transport links, a young population, the experts were able to make their predictions for where they believe property prices look set to jump.

The research highlighted the following future hot-spot identifiers for would-be property investors and buyers:

+ Local amenities; lookout for supermarkets, schools and a train line within a five mile radius.

+ Low crime rates; perhaps obviously, a low crime rate is crucial for an area to be considered an up-and-coming area.

+ Transport links; look at areas that are close to expensive postcodes, but still have great public transport links.

With house prices in London reaching an extortionate high, investors are beginning to look to other areas of the country to dip into, and so it is unsurprising that the capital is not featured among the property hotspots.

However, the inclusion of some areas, such as Rotherham in South Yorkshire and Ipswich in Suffolk, may raise a few eyebrows.

With the average UK home now valued at £204,674, and with house prices rising, buyers could potentially buy cheap in some of the up-and-coming areas identified and watch the value of their property grow quickly over time.

So where are house prices expected to increase sharply?

1/ Manchester centre – average house price = £155,029

Demand for property in Manchester is rising, thanks in part to major transport improvements in recent years, and yet house prices remain affordable.

2/ Rotherham – average house price = £136,880

The coal mining town comes in cheapest of the ten hotspots, and is undergoing a reinvention.

3/ Harborne, Birmingham – average house price = £159,436

The student area of Birmingham will eventually benefit from the HS2 rail link and a £6million investment.

4/ Leicester – average house price = £163,548

The East Midlands city offers plenty of room for growth.

5/ Hythe, Kent – average house price = £287,077

London is accessible in just over an hour thanks to the HS1 rail link.

6/ Norwich – average house price = £196,472

The city was recently targeted by the East of England Development Agency for regeneration.

7/ Hove, East Sussex – average house price = £370,622

Property prices in Hove remain considerably cheaper than nearby Brighton.

8/ Ipswich – average house Price = £179,936

Ipswich has a growing student population – a projected 15,000 new homes will help meet greater demand.

9/ Ilkley, Bradford – average house price = £346,546

Already a tourist destination, Ilkley offers good transport links and improved shopping facilities.

10/ Woking, Surrey – average house price = £404,489

There are not many parts of Surrey that you could describe as ‘up-and-coming’, but with a £50 million regeneration project underway and being 25 miles from central London, Woking offers lots of potential for growth.