The traditional autumn property price lull presents house hunters with an opportunity to potentially acquire cheaper property in the run-up to Christmas, as sellers set lower than average asking prices, as they tend to have more urgency, research shows.

Asking prices are often reduced as the festive season approaches, generally because vendors selling at this time of year usually have a greater sense of urgency to find a purchaser and sensibly recognise that trimming the asking price for their property will almost certainly provide an incentive to prospective purchasers otherwise more focused on Christmas.

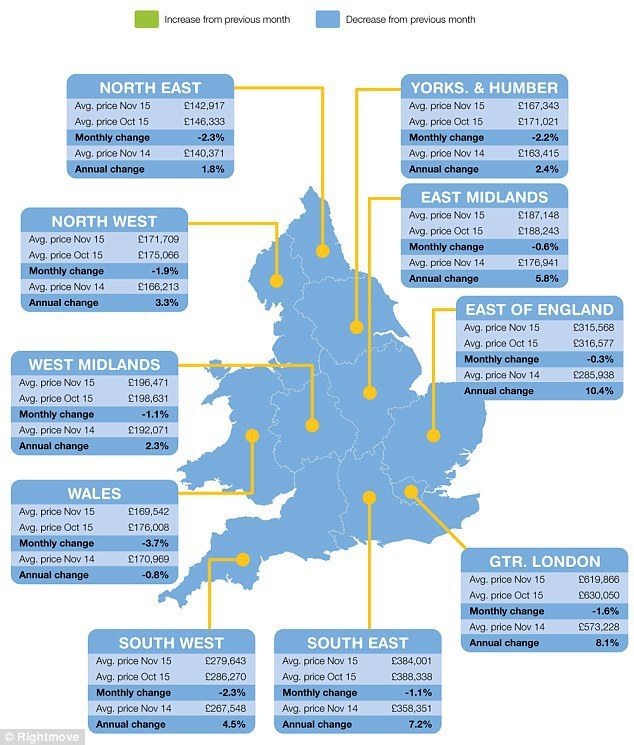

In London, average asking prices dropped in November to £619,866, compared to £630,050 in October. But a closer look at the historical house price figures suggests that this was the smallest slowdown in property asking prices in November for four years, an indication that there could be a significant increase in property prices in 2016.

House prices overall also fell, bringing the national average cost of a home down to £292,572. Again, the lower than usual November drop in property prices suggest that a steeper rise in home values could occur next year.

Meanwhile, seven in ten of the 23,000 homeowners surveyed said they expect residential property prices to rise again in 2016.

Many property professionals also forecast an increase in house prices next year, although the level will undoubtedly vary from region to region.

Josephine Ashby, director at John Bray & Partners Cornwall, said: “There is a lot of demand for great properties and a shortage of supply and that’s only going to drive prices one way. We anticipate that the activity we have been witnessing recently will continue to build well into spring 2016.”

Andy Phillips, commercial director at Knight Knox, commented: “The UK residential market is set to follow much the same path in 2016 as it’s paved over the last couple of years, with growing house and rental prices continuing to steer the market.”

“The sustained increase in house prices will further reduce the number of first-time buyers able to get onto the property ladder, steering more people into the growing private rented sector,” he added.

Tim Gray of Paramount Properties remarked: “With interest rates set to remain at all-time lows we expect first time buyers to continue to be extremely active. Vendors looking to sell their properties will quite possibly see shorter time on the market before the property goes under offer. Property prices may in turn continue to rise for the majority of one and two bedroom properties throughout 2016.

“Looking at second time buyers and larger, more expensive properties, time on the market may generally be higher and a slower rise in asking prices mainly due to the cost of the stamp duty tax. With a continued shortage of properties available to purchase and many owners preferring to extend their own properties to create extra space rather than move the, these types of properties could see an increase due to lack of supply.”