Here are a few tips to help identify if you are buying into a property hotspot.

Trying to detect an area that you believe will become the next property hotspot, complete with rising property prices, is not an easy task, but here are a few top tips to help you identify a potentially ‘up-and-coming’ neighbourhood worth investing in.

Research

Conduct careful due diligence to help identify if an area offers room for growth when it comes to property prices.

New homes and infrastructure

Stay on top of local news, and keep an eye out for things that could help boost the desirability of an area, and in turn drive up property prices, such as major new developments and infrastructural improvements.

Transport links

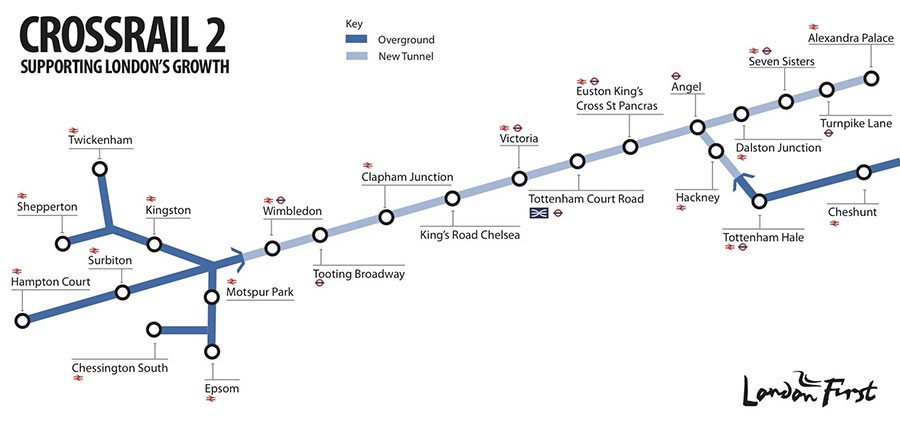

If there are plans to significantly improve the local transport network, or enhance links with larger populated areas, then it is safe to assume that this will have a positive impact on demand for property in the local area, and in turn drive up home prices.

Ripple effect

If property prices have shot up in a particular area, there is every chance that many people will find themselves priced out of the local market, and look to buy in the peripheral areas instead, in what is often referred to as the ‘ripple effect’.

Coffee shops

Smart coffee shops and trendy eateries indicate that there is growing disposable income in the area.

Estate agents

If there are plenty of estate agents in the area, it suggests that there is high demand for property.

So where in the UK is worth investing in? Here are some suggestions:

Manchester

Manchester has seen a modest rise in property values in recent years. But with the local economy rapidly improving, supported by plans to create a Northern Powerhouse, house prices look set to soar, particularly in some of the more desirable boroughs in the city.

Liverpool

Liverpool is another modern, thriving city set to benefit from the Northern Powerhouse initiative. With properties prices on the outskirts of the city centre starting from around £30,000, prices appear to offer plenty of room for growth.

Belfast

A major shortage of homes in the market is placing upward pressure on property prices in Northern Ireland, especially in Belfast, supported by the fact that Northern Ireland’s housing market remains in recovery mode, with prices and sales still significantly below their peak.

Edinburgh

Over the next 10 years more people are expected to move from the countryside to the big cities in Scotland, and where better than Edinburgh? With demand set to outpace supply, home prices look set to rise.

Oxfordshire

Property prices for country houses in Oxfordshire have increased sharply in recent years, with some experts projecting further capital growth over the medium- to long-term.

Bristol

Bristol is home to a fast growing population, including more singletons, significantly boosting demand for property in the process.

Burgess Hill

Burgess Hill in west Sussex is undergoing major regeneration. Only last month, plans were approved for the £65 million redevelopment of the Martlets Shopping Centre

Burpham

Located in Surrey, Burpham offers great value for money in comparison with nearby Guildford, and so will undoubtedly grow increasingly popular with commuters working in London.

Brent Cross and Cricklewood

The £4.5 billion regeneration of Cricklewood and nearby Brent Cross in north west London, which is set to get underway next year, will create a new town centre for the area, including 7,500 new homes, the expansion of the existing Brent Cross shopping centre, and a new Thameslink train station giving locals a 12-minute commute to central London.

Hove

House prices have soared by nearly 500% in Brighton, according to the Office for National Statistics. Many aspiring buyers are now being forced to look further out, and nearby Hove, located to the west of Brighton, appears to offer lots of potential for house price growth.